Portugal Golden Visa

Your Pathway to European Residency

Overview and Benefits of the Portuguese Golden Visa Program

The Portugal Golden Visa presents a unique opportunity for global investors seeking not only to diversify their portfolios but also to establish residency by investment in one of Europe's most dynamic and culturally rich countries. This program is specifically tailored for those who wish to invest in Portuguese investment funds, thereby contributing to the nation's economic growth while securing a promising future for themselves and their families. Here we have highlighted just a few of the benefits of Portugal Golden Visa.

European Residency

Access to live, work and study in Portugal after receiving residency cards, with visa-free travel across the Schengen Zone, enhancing your mobility and business flexibility.

Family Privileges

Extend residency benefits to your entire family: include spouse, children, and dependent parents under the same application, allowing them to enjoy the same high quality of life across Europe.

Tax Optimization

Leverage Portugal's unique tax benefits, including reduced rates and exemptions, which can significantly increase your investment returns. No taxation on foreign income unless you become a tax resident.

Citizenship Pathway

After 5 years of residency, with just 7 days of annual stay in the country, you are eligible to apply for Portuguese citizenship, opening up the opportunity to live and work anywhere within the EU.

Investment Security

Invest confidently in Portugal with its stable economy and strong legal protections, complemented by Mercan's established track record and a guaranteed buyback option for added security.

Cultural Enrichment

Immerse yourself in Portugal's rich cultural heritage and vibrant lifestyle, from its historic cities to stunning landscapes, while benefiting from the stability and security of an EU nation.

about Mercan Group

We have assisted over 50,000 immigrants to Canada from various origins and recruited more than 20,000 foreign workers to Canada, the USA, the Middle East, Malaysia, and the Caribbean. Additionally, we have raised over $2 billion in foreign investment for immigration programs in Canada, Portugal, Greece and the USA.

portugal golden visa program requirements

- Investment: Make a qualifying investment and maintain in for a minimum period of 5 years

- Age: Must be at least 18 years old

- Legal Entry: Valid passport and legal entry into Portuguese territory

- Criminal Record: Clean criminal record from the country of origin and from Portugal

- Minimum Stay: Stay in Portugal for at least 7 days during the first year and 14 days in subsequent two-year periods

- Education: No requirement

- Language: No requirement

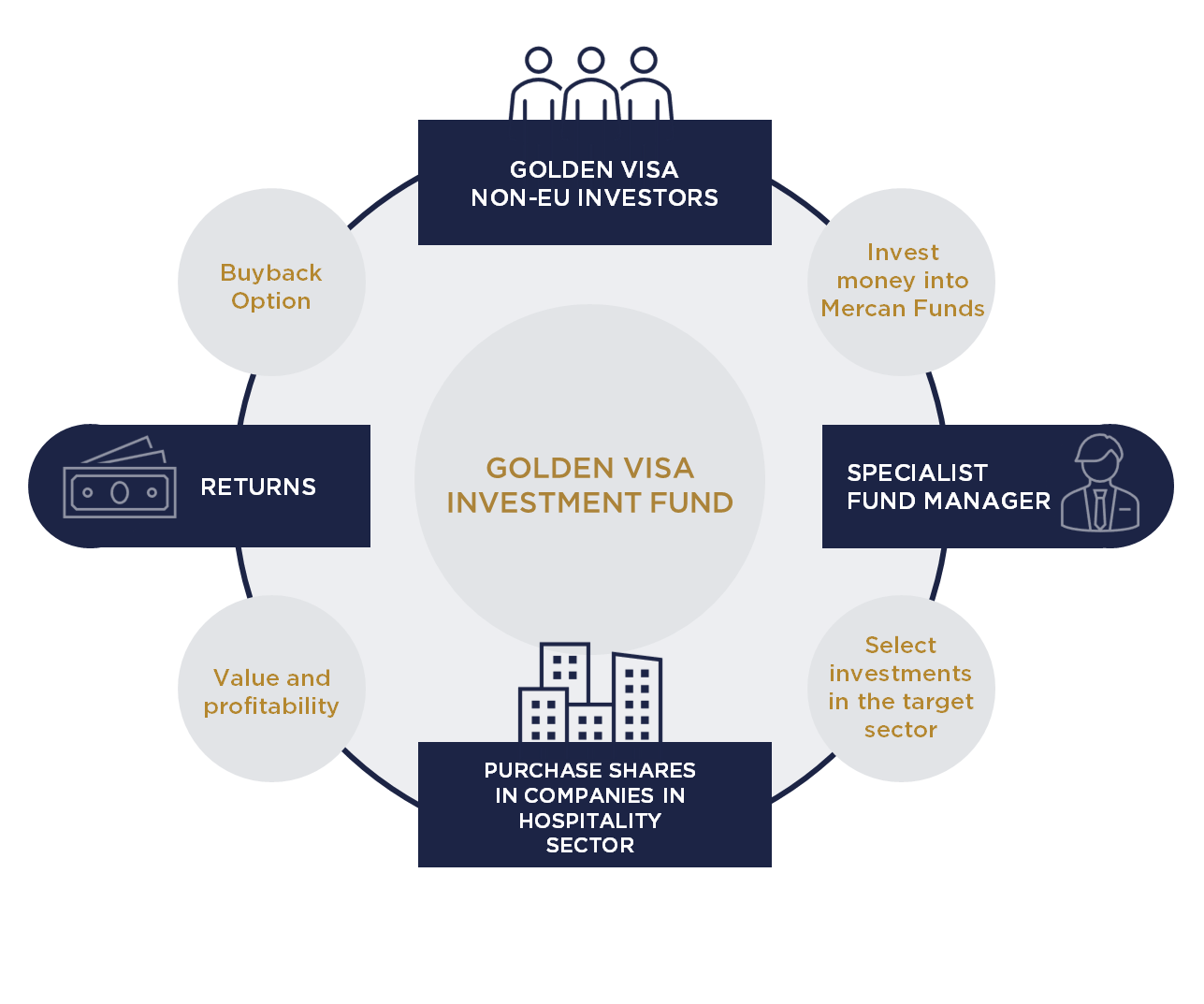

Portugal golden visa Investment Overview

- Investment Amount: €500,000

- Processing time: about 18 months

- No Tax on worldwide income

- Total Investment Fund: 140 M EUR

- Investment target sector: Hospitality sector in Portugal

- Minimum Investment time: 6 years

- Fixed Return

- Buyback

Current 5 Available Options to Qualify for Portugal's Golden Visa Program

Hospitality Investment Funds

Mercan Private Equity Fund I (MPEF I) is an eligible investment under the Golden Visa Scheme because it is not a real estate fund - it invests in projects in the hospitality sector, and its activity qualifies as an investment in venture capital. The Fund will hold majority stakes in three companies operating in Portugal's hospitality and tourism sector.

PONTE DO VAU BEACH RESORT PORTIMÃO - PHASE 3

A hotel at the rhythm of the Algarve lifestyle. This beach resort is located on the seafront just a few meters from Vau Beach. It features 3 outdoor swimming pools, a spa, gym, kids club, an exclusive private beach club close to the hotel, and a variety of relaxation areas. Its architecture, interior and exterior, was developed with respect for the surrounding environment, integrating naturally with the landscape.

ALVOR BEACH RESORT

The 5-star hotel will have 193 elegant rooms and suites, regional restaurant , spa, gym, kids club, padle tennis court, a mini golf course and an extraordinary rooftop to enjoy the perfect sunny golden hours. The Torralta Area is one of the most prestigious locations on the Algarve coast. An amazing balcony above the sea, with breathtaking views over the coastline, only a few minutes away from the historic village center, and a 10-minute walk from the Torralta beach and Três Irmãos.

BRIDGEVIEW GAIA HOTEL

This future 4-star hotel is the embodiment of Gaia’s urban life, where guests can embrace the city’s cultural heritage with a contemporary twist. The very essence of the project offers a holistic environment that encourages innovation and creativity to create an unforgettable journey along the banks of the Douro River. The hotel affirms itself as a canvas of vintage charm and modern trends, making this project the perfect place where past and present coexist harmoniously.

Ready To Invest?

Download our Free Guide or Schedule a Consultation with our experts to start your journey toward European residency today. Explore our investment options and exclusive benefits.

What is a Private Equity Fund?

A Private Equity Investment Fund in Portugal is a specialized investment vehicle that pools capital from investors to acquire and manage private companies, aiming for profitable exits. The investment strategy of Mercan Funds focuses on the hospitality sector in Portugal, investing in high-growth companies with strong potential for profitability. The fund provides a diversified investment opportunity, aligning with the Portuguese Golden Visa program, with a minimum investment of €500,000, offering both residency and financial returns.

Unlike traditional real estate investments, Mercan Funds operate as venture capital/private equity investments, ensuring compliance with Golden Visa regulations. Investors benefit from Mercan’s proven track record and a guaranteed buyback option after six years, providing a clear exit strategy and financial security.

Learn more

Partnering with Industry Leaders

Request your Guide or Schedule a Call with our Experts

Frequently asked questions

CMVM is the Portuguese Securities Market Commission, and its role is to supervise and regulate the financial instruments markets, as well as the agents that operate in them, promoting the protection of investors.

- Yes, you can include a spouse,

- Children under the age of 18.

- Financially dependent 18+ children can also be included if they are full-time students and not married.

- Dependent parents can also be included.

Yes, couples who are together by civil partnership/domestic partnership (in Portuguese União de Facto) are entitled to the Golden Visa the same way a married couple is.

The only difference is that it is necessary to prove that the union has started at least 2 years prior to the date of the application.

For the residency application, a language test is not required. It is only required when applying for citizenship or PR which will be 5-6 years after receiving residency cards.

Yes, Mercan Private Equity Fund I is compliant with Shariah Law. According to the Islamic Finance Advisory Board, the Class A1 shares are based on the Sukuk al-Ijarah model, which provides a fixed return on a limited investment. As for Class A2 shares, they are based on the Musharakah model, with profit/loss sharing after the completion of five years of the project. The Shariah Certification assessment guarantees that every aspect of MPEF I aligns with Islamic finance principles.

Introduction

The aim of this material is to provide information of some characteristics of MERCAN PRIVATE EQUITY FUND I – FUNDO DE CAPITAL DE RISCO FECHADO (the “Fund”) and is not an offering document for any securities or financial product or a solicitation of any offer to sell any security or financial product or to participate in any trading strategy. This material is intended for your analyses and your preliminary interest in receiving further documents.

Decision to Invest

Any decision to invest in the Fund should be made after reviewing the further Fund documents, which would contain material information not contained herein and which would supersede this information in its entirety, conducting such investigations as the investor deems necessary and consulting the investor’s own legal, accounting, and tax advisors in order to make an independent determination of the suitability and consequences of an investment in the Fund.

No Investment Advice

MERCAN does not provide investment advice of any kind and the decision to request further detailed information about the Fund is a judgement of the investor.

Confidentiality

The information contained herein is confidential information and any unauthorized change, disclosure, reproduction, or sharing of this document is expressly prohibited, and also its disclosure can be restricted by law in certain jurisdictions. The recipient agrees that it will, and it will cause any of its directors, partners, officers, employees, and representatives to use such information only to evaluate its potential interest in the Fund and for no other purpose.

Suitability and Risks

Investing in the Fund is speculative, not suitable for all investors, and intended for experienced and sophisticated investors who meet the required qualifications and who are willing to bear the high economic risks of such investment, which can include, but are not limited to: loss of all or a substantial portion of the investment; lack of liquidity in that there may be no secondary market for the securities and none is expected to develop; restrictions on transferring interests in the Fund; and potential lack of diversification and resulting higher risk due to concentration.

Conscious Decision to Invest

Investing in the Fund must be a conscientious decision and the Investor must evaluate if he is in position to proceed with the investment or not, at the sole risk and responsibility of the Investor. This material is not intended to provide, and should not be relied upon for, any specific investment strategy.

Forward-Looking Statements

This material can contain forward-looking statements, which give current expectations of the Fund’s future activities and future performance. Any or all forward-looking statements in this material may turn out to be incorrect. They can be affected by inaccurate assumptions or by known or unknown risks and uncertainties. Although the assumptions underlying the forward-looking statements contained herein are believed to be reasonable, any of the assumptions could be inaccurate and, therefore, there can be no assurances that the forward-looking statements included in this discussion material will prove to be accurate.

No Obligation to Revise Statements

In light of the significant uncertainties inherent in the forward-looking statements included herein, the inclusion of such information should not be regarded as a representation that the objectives and plans discussed herein will be achieved. Further, no person undertakes any obligation to revise such forward-looking statements to reflect events or circumstances after the date hereof or to reflect the occurrence of unanticipated events.

Informative and Non-Binding Nature

All the information provided by MERCAN in this material on the Fund is merely informative and non-binding, intended only to publicize the existence of the Fund, and official information on the Fund should be requested from the Fund’s marketing entity. This document is for informational purposes only and should not be relied upon.

Accuracy and Responsibility

While all of the information in this document is believed to be accurate, we make no express warranty as to the completeness or accuracy of the information, nor can we accept responsibility for errors appearing in the document. None of the Fund’s service providers shall assume or otherwise have any responsibility or any liability whatsoever to recipients, recipients’ affiliates, or any of recipients’ affiliates’ directors, officers, managers, employees, or representatives resulting from the use of the information and material contained in this presentation.

Regulatory Compliance

Interests in the Fund will not be registered under the U.S. Securities Act of 1933, as amended, or any state or non-U.S. securities laws, or with any non-U.S. securities regulator, and the Fund will not be registered under the U.S. Investment Company Act of 1940, as amended. The securities described herein have not been recommended by any U.S. federal or state or non-U.S. securities commission or regulatory authority, including the Securities and Exchange Commission. Furthermore, the foregoing authorities have not confirmed the accuracy or determined the adequacy of this document. Any representation to the contrary is a criminal offense.

Terms and Conditions

The terms and conditions of this disclaimer may be subject to change without notice and if any provision of this disclaimer is found to be invalid or unenforceable, the remaining provisions will continue to be valid and enforceable.